What you will learn

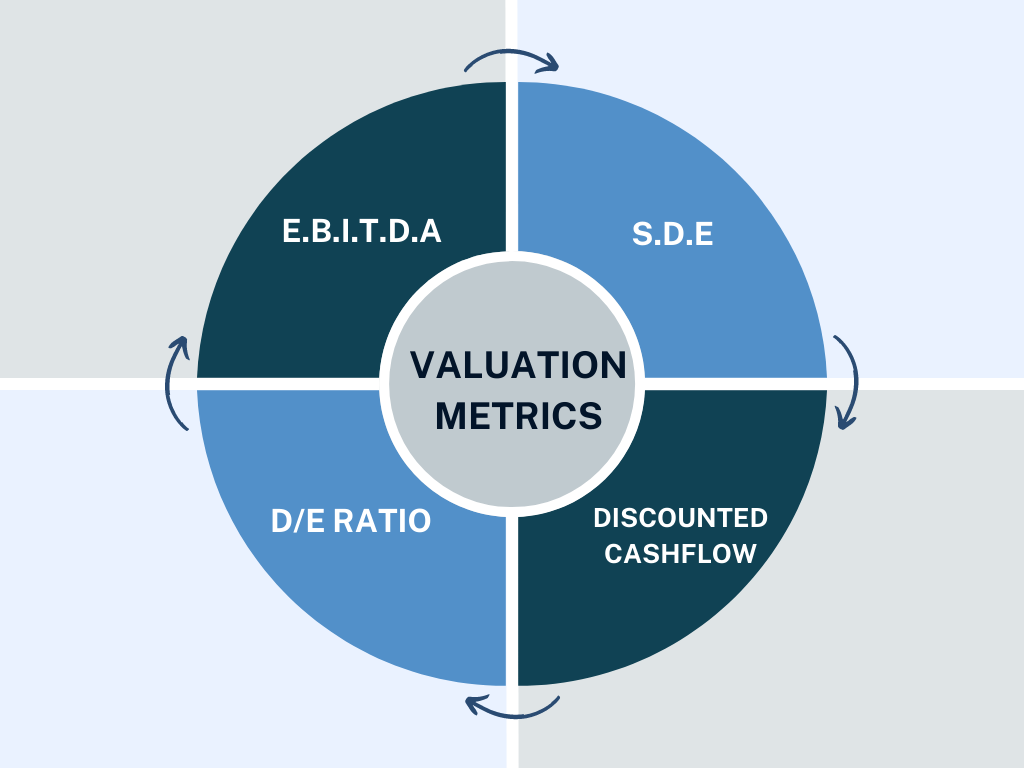

• The 4 key business valuation metrics for lower mid-market companies

• Why each of them is an important measure of the value of a company

• How they are used in valuation and other metrics

Click on a section to go directly to it

1. What is EBITDA?

2. Why is EBITDA an important measure of the value of a company?

3. What is SDE?

4. Why is SDE an important measure of the value of a company?

5. What is the D/E Ratio?

6. Why is the D/E Ratio an important measure of the value of a company?

7. What is DCF?

8. Why is DCF an important measure of the value of a company?

What is EBITDA?

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a financial metric that shows a company's profitability before taking into account non-operating costs such as interest, taxes, and non-cash expenses like depreciation and amortization. Essentially, it measures a company's ability to generate earnings from its core business operations, without considering the costs of capital structure, tax environment, and asset base.

Why is EBITDA an important measure of the value of a company?

EBITDA is widely used for several reasons:

- Comparability: Because it excludes interest, taxes, depreciation, and amortization, EBITDA can provide a "cleaner", more direct comparison of operating performance between different companies, especially across different industries and countries with different tax rates and regulations.

- Cash Flow Proxy: While not a perfect measure, EBITDA is often used as a proxy for cash flow from operations. It strips out non cash expenses like depreciation and amortization, providing insight into how much cash a company is generating from its core operations.

- Leverage and Coverage Ratios: EBITDA is a key component in calculations for various financial ratios. For instance, the Debt/EBITDA ratio is commonly used by creditors and rating agencies to assess a company's ability to service its debt.

What is SDE?

SDE (Seller's Discretionary Earnings) represents the total financial benefit that a business owner derives from their business over the course of a year. This includes the owner's salary and benefits, as well as the company's net income. SDE is used to give potential buyers a clearer picture of the business's underlying profitability and the total return on investment the owner receives.

Why is SDE an important measure of the value of a company?

SDE is particularly important in the valuation of small businesses for several reasons

- Owner Compensation: In many small businesses, the owner may decide to pay themselves a salary that does not reflect the market rate. The SDE adjustment normalizes the owner's compensation to provide a more accurate reflection of the business's earnings.

- Financial Clarity: SDE provides potential buyers with a clearer picture of the business's profitability by adding back non-cash expenses and expenses not related to the core operations of the business.

- Valuation Basis: SDE is often used as the basis for calculating the sale price of a small business. Typically, a multiple (which varies depending on the industry, market conditions, and specific business factors) is applied to the SDE to determine the business's value.

What is the D/E Ratio?

The Debt to Equity Ratio measures the proportion of a company's funding that comes from debt compared to equity. A higher D/E ratio means that more of the company's operations are financed by creditors (debt) rather than by investors (equity), indicating higher financial risk.

Why is the D/E Ratio an important measure of the value of a company?

- Risk Assessment: The D/E ratio provides insight into a company's financial risk. Companies with higher D/E ratios are more reliant on borrowed money and thus may be seen as riskier since they have more obligations to repay.

- Capital Structure: The D/E ratio offers an understanding of a company's capital structure, indicating how it finances its operations and growth - either through debt or equity.

- Investor Return: Equity holders are paid after debt holders. Therefore, if a company with high debt goes bankrupt, there might be little left for equity holders. This is why equity investors often prefer companies with lower D/E ratios.

- Industry Benchmarking: The D/E ratio can be used to compare companies within the same industry. Different industries have different average D/E ratios, so it's important to compare companies to their industry peers.

What is DCF?

DCF (Discounted Cash Flow) is a financial modeling methodology used to estimate the value of an investment based on its expected future cash flows. The DCF method involves projecting the free cash flows the investment is expected to produce in the future, and then discounting these cash flows back to their present value using a discount rate (often the weighted average cost of capital, WACC) that reflects the riskiness of the cash flows.

Why is DCF an important measure of the value of a company?

- Intrinsic Value: Unlike relative valuation methods that use multiples (like P/E or EV/EBITDA), DCF aims to calculate the intrinsic value of an investment, based on its own cash-generating potential.

- Cash Flow Based: DCF focuses on cash flows, which are harder to manipulate than earnings and are a key driver of investment returns.

- Risk Adjustment: The discount rate in a DCF adjusts the value for the riskiness of the future cash flows. Riskier investments should have higher discount rates, leading to a lower DCF value.

- Flexibility: DCF models can be tailored to reflect the specific characteristics and growth prospects of the company or investment being valued.

Ready to grow your business?

Start by speaking with an expert on our team.